property tax attorney dallas texas

Call us at 877 652-2707 for delinquent data pricing today. Wood say theres more to it than meets the eye.

Why Texas Property Taxes Are Expected To Skyrocket Again This Year San Antonio Business Journal

Or contact us and well get back to you.

. Convenience Fees are charged and collected by JPMorgan and are. Just because you can defer doesnt mean it goes away says Wood who works at Meadows Collier Reed Cousins Crouch Ungerman in Dallas. This program is designed to help you access property tax information and pay your property taxes online.

As of the 2010 census the population was 2368139. It is a subdivision off of the State of Texas. Property taxes are collected by the local taxing authority each year to help fund necessary public services for the area.

While most homeowners pay their annual tax bill some do not. Delinquent Tax Data products must be purchased over the phone. Dallas County is a county located in the US.

While in theory property tax deferment may sound like something to take advantage of tax attorneys like Mary E. As a leading provider of delinquent property tax loans in Texas Tax Ease has helped thousands avoid foreclosure and get their lives and businesses back on track. It is the second-most populous county in Texas and the ninth-most populous in the United States.

How property tax payments work. The Dallas Appraisal District is responsible for appraising property for the purpose of being able to identify property tax amounts. Its county seat is Dallas which is also the third-largest city in Texas and the ninth-largest city in the United States.

Call us at 877 652-2707 for delinquent data pricing today. TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Denton County TX and want the data in a standard form. Delinquent Tax Data products must be purchased over the phone.

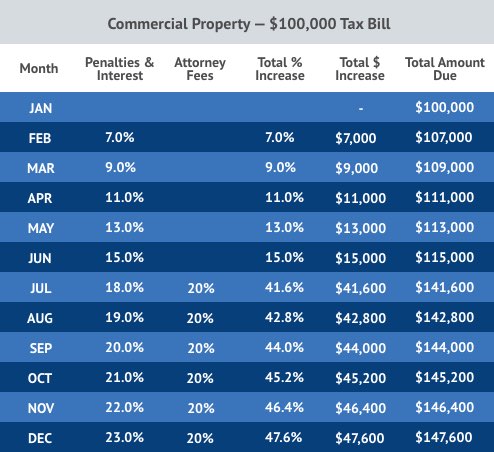

Or contact us and well get back to you. Even though we have offices in Dallas Houston and McAllen we can provide you with a. If payments are not made to the county treasurer in a timely manner they become delinquent incurring interest and fees each month.

TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Bexar County TX and want the data in a standard form. They are responsible for assessing and determining accurate property value on all properties in Texas and will include providing services on property owner search.

Paying Property Taxes Late What Happens If You Don T Pay Property Taxes In Texas Tax Ease

3 Best Tax Attorney In Dallas Tx Expert Recommendations

Tax Attorney Irs Lawyer For Dallas Tx Scammahorn Law

Texas Property Tax Disputes Capabilities Vinson Elkins Llp

Carlson Property Tax Dallas Property Tax Protest Property Tax Appeal

3 Best Tax Attorney In Dallas Tx Expert Recommendations

Brusniak Turner Fine Llp Texas Property Tax Attorneys

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Dallas Property Tax Loans Dallas Home Tax Solutions

12 Million Highland Park Mansion Owned By Tax Attorney Recently Visited By Feds Is Up For Grabs

Property Tax Attorney Dallas Texas Litigation Consulting Planning

Property Tax Lawsuits I Ve Been Sued Now What Property Tax Texas Law In Law Suite

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Penalties For Failure To Pay Property Taxes Texas Property Tax Loans

Learn About Dallas County Property Taxes

Delinquent Property Taxes Dallas County Texas Learn About Dallas County Property Taxes Now Tax Ease

How Does The County Make An Assessment Republic Of Texas Assessment Tax Protest